When Anne Graham found out she was in the Advisely Index top 10, she realised it was because of the little things – small changes that, over time, had a tremendous effect on the efficiency of her business.

Here, she explains what those changes were.

In the world of financial planning, success often hinges on the ability to make sound decisions and implement effective strategies.

While big leaps forward may grab the headlines, it's the consistent, incremental improvements (or tiny tweaks) that lay the foundation for long-term success. To show you why, I'll explore five small changes that led to significant results in my own financial planning business.

1: Client communication and engagement

Communication is key in a financial planning business, and implementing small changes to enhance client communication channels can markedly improve engagement and satisfaction.

As an example, I'll schedule regular check-ins via email or phone calls and send out informative newsletters. These small improvements build trust and strengthen my relationships with clients over time.

2: Streamlining processes and workflows

Efficiency is paramount in any business; financial planning, obviously, is no exception. By regularly reviewing and refining internal processes and workflows, even small gains in efficiency can accumulate over time.

While the benefits of automation in advice are well-understood, I think the way you implement it is just as important. When implementing new software tools, I don’t try to do everything all at once; instead, we have a program of gradual change.

This makes it easier for everyone to adapt and embrace new systems. Incremental improvements, when implemented well, free up time and resources, allowing me to focus on more value-added activities.

3: CPD

Staying ahead of the curve (and meeting our compliance requirements) requires ongoing learning and development.

I’m a great believer in education, and I think encouraging advisers and staff to pursue continuous education through workshops, seminars, or online courses can lead to incremental gains in knowledge and skills. These small investments in professional development not only enhance the quality of service provided to clients but also keep the business competitive in a dynamic market environment.

4: Client feedback and adaptation

Feedback from clients is invaluable for identifying areas of improvement and refining service offerings. Implementing a system for gathering and acting upon client feedback, whether through surveys, reviews, or one-on-one discussions, allows for continuous adaptation and refinement of the financial planning process.

By making small adjustments based on client input, we can demonstrate responsiveness and a commitment to client satisfaction.

5: Embracing technology and innovation

Technology continues to reshape the financial planning landscape, offering new opportunities for efficiency and engagement. Incremental improvements in technology adoption, such as integrating new software tools or leveraging AI-powered solutions, can enhance the client experience and streamline business operations.

Over the years I’ve tried various tech solutions – some have worked and others haven’t. But by staying open to innovation, we can stay ahead of the curve and deliver value in new and exciting ways.

I believe the journey to success in a financial planning business is not marked by dramatic leaps but by the cumulative impact of tiny tweaks and small wins made over time. By focusing on areas such as client communication, process efficiency, professional development, client feedback, and technology adoption, we have built a solid foundation for long-term growth and success.

In the world of financial planning, every small step forward counts towards achieving big results in the end.

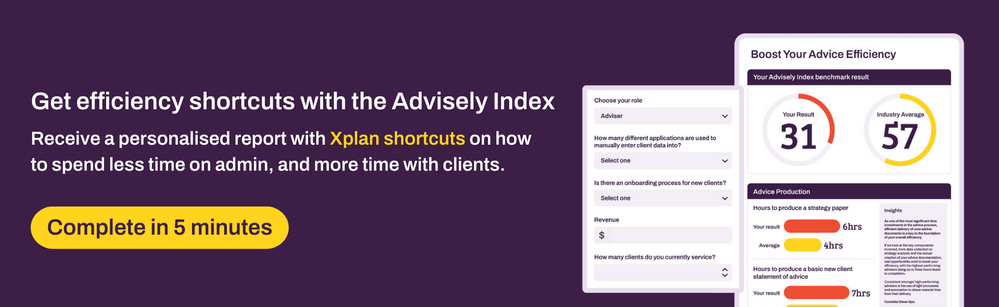

The first step in accelerating your journey to efficiency, like Anne did, is to understand where you sit today. In 5 minutes, you can take the Advisely Index here.

Advisely Board

Advisely Board